Here’s Why Trump’s “50-Year Mortgage” is a Terrible Idea

It’s a “solution” no one asked for, and it would only make the housing crisis worse.

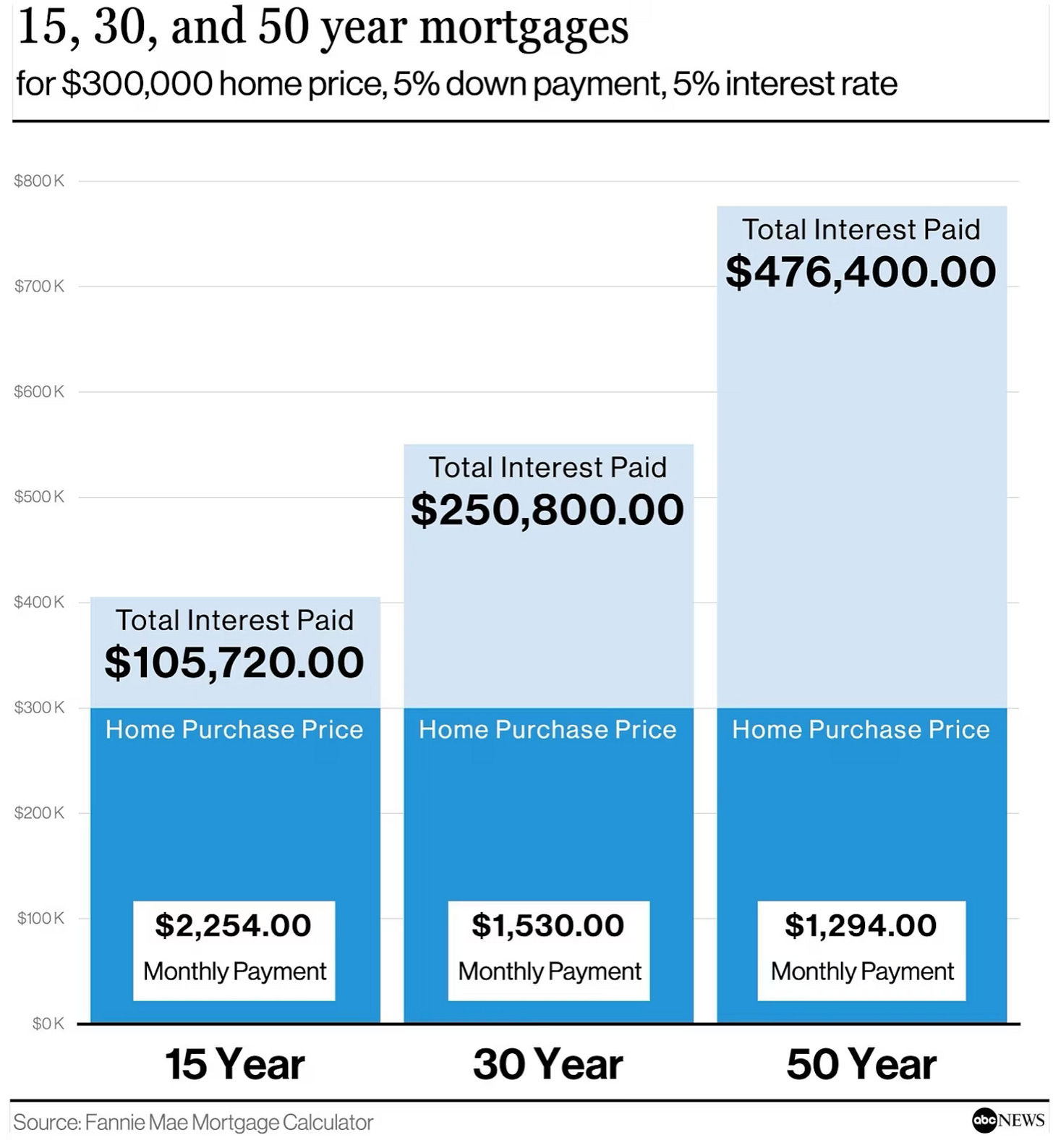

Donald Trump’s latest idea to tackle sky-high housing costs is to stretch mortgages to 50 years, a huge change to US housing policy. The proposal, floated by Trump on social media after a chat with a housing adviser, is touted as a way to lower monthly mortgage payments for young homebuyers. However, economists and even some of Trump’s usual allies are criticizing the 50-year mortgage as a misguided “quick fix” that traps Americans in debt for life while doing nothing to bring down the actual price of a home.

It’s just another example of Trump tossing out some half-cooked, hair-brained scheme to placate his followers, or distract from the fact that he has no actual plans to deliver on his campaign promises. One year in, the reality of Trump’s second-term policy agenda is abundantly clear: higher prices, slower job growth, and an economy that’s less competitive and dynamic than it was when he reentered office. And it’s ordinary Americans who are bearing the brunt of this economic dislocation and Trump’s particular brand of economic illiteracy.

Golden Handcuffs?

For a young millennial couple eager to buy their first home, the 50-year loan seems like the ticket. A quick comparison shows the monthly cost of a 50-year mortgage saves hundreds of dollars compared to a standard 30- or 15-year mortgage.

Let’s take a hypothetical couple, Alex and Jamie. They scrape together a down payment in their early 30s and lock in a 50-year mortgage. In the beginning, they love the low monthly bill. But, with such a long term loan, they realize that most of their payments went to the interest, and they’ve built nearly zero equity. Here’s why:

If Alex and Jamie take out a $360,000 mortgage (after 10 percent down1 on a $400,000 home) at 6.25 percent interest over 50 years, here’s what happens after 10 years:

They’ve paid a total of: $235,428

Of that, only: $14,436 went toward reducing the loan principal

They still owe: $345,564

So after a decade of payments, they’ve only built about 6 percent equity beyond their down payment, and over 94 percent of what they paid went to interest. That’s a staggering imbalance, showing just how slowly equity builds under a 50-year mortgage. They’re effectively stuck; selling the house would barely cover what they still owe. Once you calculate realtor fees and closing costs, they realize their home has become a financial trap.

Take another example.

Sofia is a single mother of two. She’s proud to buy a modest home with a 50-year mortgage, hoping the lower monthly payments will finally give her family stability. But what looked “affordable” on paper quickly proves otherwise. Like many first-time buyers, she didn’t fully factor in the hidden costs of homeownership: the roof that starts leaking in year six, the property taxes that keep rising, and the utility bills that spike every winter.

With so much of her income tied up in a mortgage that barely chips away at the principal, there’s no cushion left for repairs or emergencies. Unlike a 15- or 30-year mortgage that builds equity and ends before retirement, Sofia faces the unsettling reality of paying a mortgage well into her 70s—on top of all the other bills that come with owning a home. The house that was supposed to bring financial security becomes a source of chronic stress.

A Gimmick Destined to Backfire

Trump’s 50-year mortgage has been met with such disbelief because it offers illusory affordability. The appeal is obvious: lower monthly payments are attractive when housing costs feel out of reach. But shifting the burden to future decades doesn’t actually save money—it dramatically increases the total cost. It’s akin to stretching a 6-foot blanket to 10 feet by thinning it out—you cover more area, but the fabric (your budget) gets frayed in the process. Homebuyers enticed by a 50-year loan might find themselves paying nearly double for the same house, and handing huge profits to banks in interest over the years.

There’s also a generational fairness issue. A young couple who buys a home under a 50-year mortgage could still be paying it off when their grandchildren are born. They might never experience the peace of owning a home free and clear, which past generations enjoyed after 15 or 30 years of payments. Instead, tomorrow’s homeowners could be making mortgage payments right up until they stop working—or until they die.

And if a homeowner needed to sell or move, the ultra-long term could complicate things even further. Few buyers are likely to jump at the chance to take over a decades-long loan unless the mortgage is “assumable” (meaning the buyer can legally take over the seller’s existing loan) or “portable”—a rare feature that would allow the seller to carry their mortgage to a new property without starting from scratch. Trump’s team has hinted they’re looking into this kind of portability, but such options are not standard in today’s US housing market and would require significant policy changes. Without those features, selling a home with 40+ years left on the mortgage could be a hard sell—literally.

The Real Problem: Supply!

America’s housing affordability crisis stems from a severe lack of housing supply. Home prices are still roughly 60 percent higher than pre-2020 levels on average, after a pandemic-era surge that outpaced incomes. As a result, the typical U.S. homebuyer now must spend about 39 percent of their income on housing, far above the traditional 30 percent affordability threshold. By one recent estimate, the median household income (about $87,000) falls roughly $25,000 short of what’s needed to afford the median-priced home. It’s no surprise that the median age of first-time homebuyers has climbed to a record 38 (up from age 28 in the early 1990s).

So what’s causing the shortage of reasonably priced homes? Experts point to years of under-building, restrictive zoning and regulations, and other barriers that have constrained housing construction. “The problem is the lack of supply,” emphasizes Wharton real estate professor Joseph Gyourko. “It’s just easy to stop development in the United States … The longer-run problem is the lack of new building of homes.”

If we don’t build more houses, they will stay expensive. This is one point on which economists on both the right and left agree. No creative mortgage product or Trumpian scheme can paper over the fact that there aren’t enough homes in most communities. Demand-side subsidies or easier credit without new construction just lead to higher prices.

A 50-year mortgage would be a nightmare for all future generations. Like so much of what this administration is selling, it’s vaporware meant to dodge addressing the real issue—not a real, well-thought-out proposal. And as more people recognize that, hopefully this idea will remain what it currently is: a silly footnote in the housing debate, rather than a policy that millions are forced to live with (and pay for) for the next half-century.

Tahra Hoops is Director of Economic Analysis at Chamber of Progress, where she provides real-time analysis of economic news and trends. She writes The Rebuild Substack.

The median down payment for a first time buyer is about 9 percent.

Thanks for laying this out so well. How many ways are there to say "bonkers?"

How about writing about what Airbnb and VRBO has done to supply in states like Michigan. Looks like a huge problem no one talks about.

Roger Parkins